On June 2, 2014, the Seattle City Council passed into law new minimum wage standards that take effect April 1, 2015. In order to help employers understand the changing landscape, we summarize the key areas of the ordinance.

The new law affects employers differently depending on their size. “Large Employers” employ more than 500 employees, including franchisees associated with a network of franchisees that employs more than 500 employees; the ordinance refers to them as Schedule 1 Employers. “Small Employers” employ 500 employees or less; the ordinance refers to them as Schedule 2 Employers.

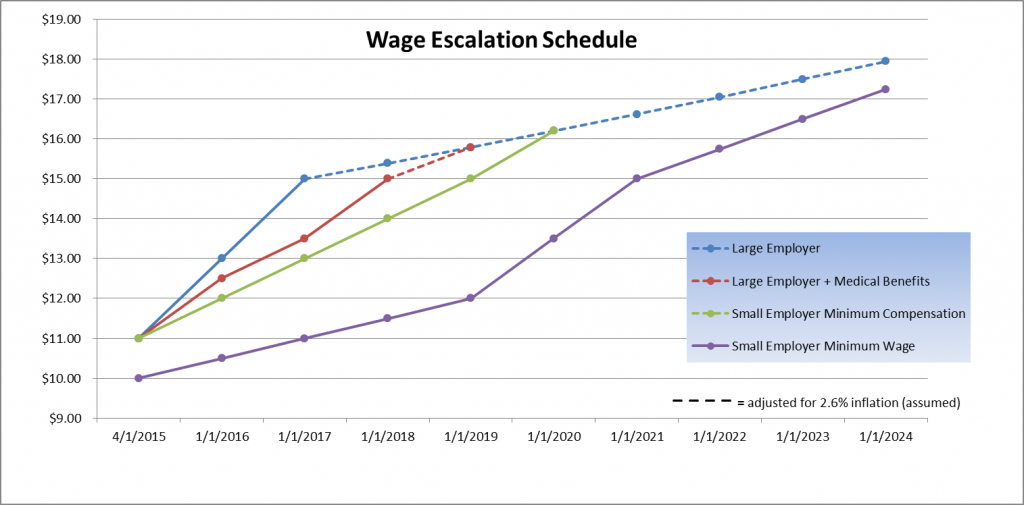

Large Employers. Large Employers must begin paying at least $11 on April 1, 2015. Over the next two years, Large Employers must increase that amount until the $15 mark is reached on January 1, 2017. The chart below shows the wage escalation schedule. Large Employers that pay toward “medical benefits” (silver level or higher), begin paying $15 on January 1, 2018, and have a slightly slower escalation schedule. See chart below. Bonuses, commissions, and piece-rate payment count toward the minimum wage; tips do not count for Large Employers.

Small Employers. The ordinance is slightly more complex for Small Employers. Two definitions are important for understanding the schedule for Small Employers: “wages” and “compensation.” The ordinance defines a wage as any cash paid to an employee as a wage, a bonus, a commission, or for piece-rate work. The ordinance defines compensation as wages plus tips (received and reported to the IRS) and medical benefits.

For Small Employers, the ordinance gives two escalation schedules: one for wages and one for compensation. Think of the wages schedule as the cash floor. Every Small Employer must pay their employees this minimum amount in cash alone. Compensation includes wages but allows for the difference to be met by counting tips and medical benefits.

Hang with us—an example should clarify. On April 1, 2015, Small Employers must pay a minimum wage of $10, and a minimum compensation of $11. This means that the $1 difference between the minimum wage and minimum compensation can be made up by counting tips and medical benefits. What if employees do not receive tips or medical benefits? That employer still must meet the minimum compensation level, meaning they will have to pay $11 per hour in cash. Another example: on January 1, 2016, Small Employers must pay $10.50 in wages, and $12 in compensation. So, a restaurant that employs 20 people will have to compensate its employees at $12, but it will be allowed to credit $1.50 from its servers’ tips.

When must employers pay $15? The $15 mark will be reached on these dates:

- Large Employer…………………………………………………………………………. Jan. 1, 2017

- Large Employer + Medical Benefits………………………………………………….. Jan. 1, 2018

- Small Employer Minimum Compensation…………………………………………. Jan. 1, 2019

- Small Employer Minimum Wage…………………………………………………….. Jan. 1, 2021

Once Large Employers hit the $15 mark, according to their unique wage escalation schedule, the wage will continue to rise according to inflation (CPI-W). Once Small Employers reach $15, they must pay their escalation schedule or Large Employers’ schedule, whichever is lower. The chart below shows each employer’s timeline, assuming a CPI-W rate of 2.6% for example purposes only. Solid lines represent the escalation schedule laid forth in the ordinance; the dotted lines represent adjustment for inflation at an assumed rate of 2.6% per year.

Which employees are entitled to the new minimum wage? The new ordinance broadly defines an employee as “any individual employed by an employer,” subject to 14 exceptions. Persons who fall under one of these 14 exceptions are not entitled to the new minimum wage. However, that person will still be counted as an “employee” for determining the size of the employer. Here is a partial list of exempt employees:

Which employees are entitled to the new minimum wage? The new ordinance broadly defines an employee as “any individual employed by an employer,” subject to 14 exceptions. Persons who fall under one of these 14 exceptions are not entitled to the new minimum wage. However, that person will still be counted as an “employee” for determining the size of the employer. Here is a partial list of exempt employees:

- Executives, professionals, and those working in an administrative capacity

- Volunteers for educational, charitable, religious, or other nonprofit organizations

- Any person who must reside or sleep at the place of employment

- Any person who spends a substantial portion of his or her work time “on call” but not actively working

- Students employed under a “work study” agreement

The new ordinance permits an employer to apply for exemptions for apprentices, learners, messengers, and disabled employees. A separate minimum wage level will later be determined for employees under 18 years old.

What about employees who only infrequently work in Seattle? Any nonexempt employee who works in Seattle for two or more hours per two week period is entitled to the new Seattle minimum wage for the hours worked in Seattle.

How much do employers have to pay? While most people discussed the ordinance as the “$15 minimum wage law,” it has implications after the $15 wage is reached. The minimum wage will continue to rise to keep with inflation (CPI-W). Note that the minimum wage schedule for Small Employers is set through 2024. However, if Small Employers’ schedule surpasses that of Large Employers (due to very low inflation), then Small Employers will pay the lower rate. After 2024, the minimum wage will be the same regardless of employer size.

How do employers comply? First, employers must provide notice of the minimum wage in the languages of their employees. Posting in a conspicuous workplace location satisfies the notice requirement. Second, employers must comply with the new minimum wage starting April 1, 2015.

What happens to employers who do not comply? A first time violation of the notice requirement could result in a $125 fine; subsequent violations could result in fines of up to $250 per violation. An employer who fails to pay the minimum wage is subject to a warning and a fine of up to $500 for the employer’s first violation. For a second violation, an employer may be fined up to the greater of $1,000 per employee or 10% of unpaid wages. After that, an employer may be fined up to the greater of $5,000 per employee or 10% of unpaid wages. The maximum penalty is $20,000 per employee.

If you have questions about Seattle’s new minimum wage ordinance or other employment issues, please contact Daniel Ichinaga (206-682-0565 or dichinaga@elmlaw.com) or Nat Taylor (206-682-0565 or ntaylor@elmlaw.com).