Auto Insurance – Three important types of coverage

You have your car or truck, but what about your insurance? Auto insurance is a common form of insurance, but sadly according to the Insurance Commissioner, it generates more complaints than any other type of insurance. This is not surprising because individuals often do not understand their insurance coverage until there’s an accident. Here some of the things to consider when buying or renewing your auto insurance.

Know What You Have Purchased

Insurance is a contract between you and your insurance company. There are two basic obligations undertaken by the insurance company. First, is a duty to defend you, that is hire an attorney to provide a full defense in any covered lawsuit against you. Second, your insurance company is obligated to pay for damages up to the amount of the coverage obtained.

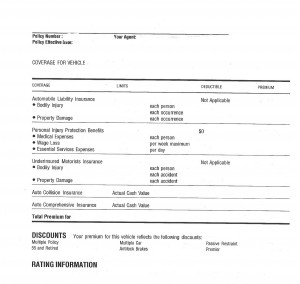

Let’s take a look at this second obligation in particular. The place to start is your Declaration Page, which you will receive when buying insurance or receiving your annual renewal. You can change it at any time. Your Declaration Page will have your limits, your deductibles, your premiums by category and your total annual premium for each vehicle. Here’s a sample Declaration Page. Your focus should be on the first three categories of coverage:

Reading the Declaration Page

The three sections that should be reviewed are: Liability Coverage; Personal Injury Protection (PIP) and Underinsured Motorist (UIM). Unfortunately too many people fail to understand what they have purchased until after they have been in a serious accident. Don’t get caught in the insurance advertising trap of focusing on insurance premium payment reduction to such an extent that you put yourself; or leave yourself without sufficient medical coverage. It happens far too often.

1. Liability Coverage

Liability coverage is legally required in Washington, with minimum limits of $25,000 per person / $50,000 per occurrence and it pays for someone else’s bodily injuries that you cause. Under our state’s Financial Responsibility laws, failure to have insurance can cause you to lose your license for 3 years if you cause an accident while driving uninsured. So of course, do not drive without insurance. http://www.dol.wa.gov/driverslicense/suspenduninsuredaccidents.html

But minimum limits often are not enough to protect you from claims in serious accidents. You should buy liability coverage in a sufficient amount to protect you and your assets in a serious accident; do not try to lower your premiums by reducing this coverage. It is far too valuable.

2. Personal Injury Protection (PIP)

PIP covers your individual medical bills and wage loss. And it covers your passengers, injured pedestrians or bicyclists, regardless of fault. PIP will be provided unless you reject it in writing. PIP pays 100% of your medical bills up to the amount of coverage, generally $10,000, but available at $35,000 for a modest increase. PIP coverage is available from your insurance company to you or your passengers immediately after an accident. So in a situation where you have to wait to obtain your full recovery for a collision caused by another, your medical bills are paid 100% while your claim is being pursued. PIP is advisable and should not be rejected.

3. Underinsured Motorist Coverage (UIM)

UIM covers you and your passengers if the at fault driver is underinsured. Since so many drivers have insufficient liability coverage, UIM is very important. In fact, the law requires that UIM be offered in every case—in the same amount as your liability coverage-but may be rejected in writing. Again, some might suggest you reduce or reject UIM coverage to lower your premium but that is unwise. And if it is rejected in writing one year, that rejection may be used every time you renew.

The other typical forms of insurance provided are Collision and Comprehension. These cover respectively, damage to your vehicle by collision regardless of fault and damage to your vehicle by fire, vandalism, theft except for portable items, iPods, cell phones, etc. This type of coverage is where you want to lower you premiums by increasing the deductible.

The Washington State Association for Justice (WSAJ) has a helpful brochure entitled Understanding Your Auto Insurance. Washington State Association for Justice Auto Booklet

Also, The Office of The Insurance Commissioner has helpful information including companies that provide high risk insurance if you are unable to qualify for Premium or Standard rates. http://www.insurance.wa.gov/your-insurance/order-publications/documents/auto-insurance-guide.pdf

If you have questions about your coverage or an accident contact Mike McKinstry or Kate Anderson at no charge for the initial conference.